Marketing Profile: Dutch Bros Coffee

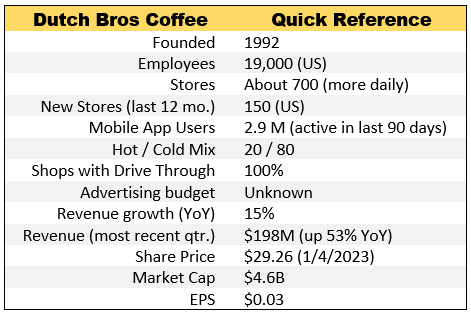

This week is all about one rebellious coffee shop chain, Dutch Bros. It’s a story about an overnight sensation made in thirty years, with a bit of local boys made good, and topped off with a splash of David and Goliath. Dutch Bros is 100% drive through, and sells 80% cold drinks. They operate about 700 shops in North America, 150 of which were opened in the last 12 months.

North Americans drink 1.87 cups of coffee per day per capita (Statista), so those who drink coffee drink a lot. The industry took a big hit from the pandemic in 2020, dropping by 18% (also Statista, see links and references at the end). Let me know if you can explain why we would drink less coffee during a pandemic. Even instant coffee dropped! It must have something to do with travel patterns, or maybe just less wasted coffee? Preliminary estimates have 2022 just a bit (3.3%) over pre pandemic levels.

Ok, enough background stuff we could get from Wikipedia or ChatGPT and on to Dutch Bros marketing!

Rebels Meet Wall Street

Dutch Bros picked Rebel as the name of their iced energy drink brand. Rebel adequately captures their spirit of fun and the pride they have in being different. Get a load of the team ringing the bell at the NYSE:

But can rebels build lasting brand value? When I get in line for a cup of coffee, I want to know that the person I am waiting to be served by is going to deliver what I expect. Personality experts say a rebel: “resists both inner and outer expectations”. Missed expectations degrade brand relationships – just as another rebel brand, Southwest Airlines, found out last month. Wall Street also penalizes missed expectations.

I love the way they have used the fun, irreverent, different, and rebellious culture to attract the best employees and build lasting customer relationships. This is an enormous asset for the company. A multiplier effect on brand value no question.

The company is also executing high growth and high quality every day in boring, predictable, non-rebellious ways. I suspect the Dutch Bros new employee onboarding process turns these contrasting elements into their own definition of rebel.

It may make sense to start a campaign to share that definition of rebel with the world. The world could use better leadership in this area.

Massive Difference, One Cup at a Time

The next message projected by Dutch Bros is “making a massive difference, one cup at a time!” Of the six main sections on the website (dutchbros.com), half (Story, Impact, and Careers) use “make a massive difference” language to highlight how Dutch Bros is good for the community. According to the Dutch Bros 2021 Annual Report, the Dutch Bros Foundation awarded gifts of $3.3 million through three programs: Dutch Luv, Drink One for Dane, and Bucks for Kids. This giving undoubtedly does make a massive difference for the recipients. It equates to 0.66% of revenue, a respectable number for sure. In addition, Dutch Bros employees get 16 paid hours per year to contribute to local causes, which is another great way to make an impact.

Dutch Bros has also projected their aspirations in environmental, and diversity – equity – and inclusion, but don’t have much in the way of data or stories to support it.

When opening a new store every other day, hiring over 200 people per week, and growing revenues at over 50% per year, it will be difficult to keep up with philanthropic promises. As much as Dutch Bros crows about making a massive difference, they cannot let their promises and the reality get too far apart. A day will come when they will not get a pass for being the fun rebellious local boys anymore, and they will need a body of evidence to back up the promises.

A steady stream of evidence of the massive difference may be needed.

Going There

It’s 15 miles to the nearest Dutch Bros for me. Not on the way to anywhere I was going. But I couldn’t write about the sensation without experiencing it. Thank goodness for Google Maps, because this was a “B” location at best. Access to the driveway was through another store’s parking lot. When exiting I saw why Google routed me through the parking lot – there was no way into the shop from the main street.

Evidently, 1 PM is the slowest time of the day, not a single car in line. I explained my newbee-ness and the Broistas (that is what they call themselves) gathered around to see the visitor from another planet. Everyone was super friendly, the music was on, and it was indeed fun. They do stay open until 11 PM, and confirmed it was busy every night, and every day. They were as surprised as I was about the thin crowd right then – and did not seem worried about it. There were two Starbucks nearby, they did not seem worried about them either. So ease of access, visibility from the street, and time of day are not tied to the industry convention. Go Rebels!

I was able to find a couple of reports of Dutch Bros shops closing. They were closed down by local authorities because their long lines impacted traffic patterns. Crazy.

Waiting in Line

Any 100% drive through business must be evaluated on the experience in line. Waiting in line is a thing by itself. What else can explain that empty restaurant right next to the hip one with a 45-minute wait. According to QSR’s 2022 Drive Through Report, which did not include Dutch Bros Coffee, but bear with me, Chick-fil-A had the slowest speed of service but also the highest customer satisfaction. Chick-fil-A paid attention to customers while in line, often working down the line taking orders before reaching the window.

Dutch Bros employs similar methods, including double or triple drive through lanes and even an “escape lane” that customers can use to escape the line should they get their order earlier than the person in front of them. At this rate of growth, Dutch Bros will be in QSR’s survey soon. I suspect they will match the Chick-fil-A pattern: super loyal customers having fun and feeling appreciated, even though the line is long.

There is clearly a cool factor associated with Dutch Bros, and I am notoriously bad at quantifying cool. But if they lose the cool, I don’t know of a proven method for restoring it. I know I’m not cool, so it is possible I am worrying about nothing.

Advertising

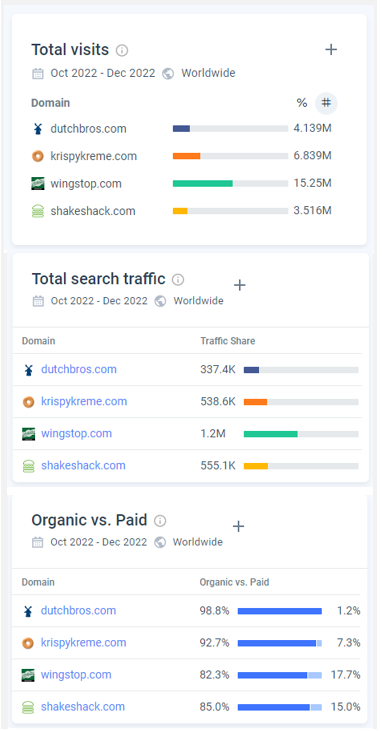

I can find very little evidence of a Dutch Brothers advertising budget. Jeff Bezos once said: “Advertising is the price you pay for having an unremarkable product or service.” When his company grew up a bit, he had to change his mind. I hate advertising too, and any Chief Marketing Officer (CMO) would love to be able to succeed without it. And it would be easy to not think about advertising when web traffic is 98% organic, and 89% branded (similarweb). But eventually the tailwinds from the IPO and the visits to Mad Money will wash out and other drivers may be needed.

Mobile app usage is a bit harder to compare, particularly with a new app. Dutch Bros is off to a great start with very good app reviews in both app stores (apptopia). Starbucks is so big and so established in the marketplace that meaningful competitive learning is hard to come by.

Dutch Bros is making the right moves in mobile, but may need to work on some plans for advertising in the future. Small field driven campaigns featuring (and benefiting) the organizations the Broistas pick to spend their 16 hours of community give back time on might work.

Social Media

The best way to describe Dutch Brothers social media is “field driven.” Massively field driven. On Twitter, every shop has its own account and the account names often do not even have Dutch Bros in them. You have to be on the inside to follow your favorite shop. On Facebook they post pictures of new stores – without any indication of their location. After each post there are dozens of comments – asking where it is and with fans saying they really need a shop in their town. Gotta get some Unicorn Blood! There is no way to know how many followers Dutch Bros has because there are hundreds of accounts ranging from two actual guitar playing Dutch brothers from the Netherlands to anyone and even a dog.

Having such a high volume of employee and customer engagement is the dream of every marketer - and every CEO. There is no “quiet quitting” going on at Dutch Bros. Their people are all in.

But if this goes wobbly, it could be hard to course correct. Employing a method for measuring SoMe sentiment and participating in the flow may be worth the investment. Doing so without screwing it up will require a very delicate touch.

Marketing Strategy

So, what does John Graham, the CMO, think about each day? These are entirely guesses on my part, I have no information from inside the company. I would love to hear any thoughts about my guesses in the comments section below.

Dutch Bros field driven marketing tactics may map to a strategy, or they may be a way to try a lot of things all at once and learn fast in parallel. Before their mobile app came about, customers sent texts directly to their favorite Dutch Bros employee’s personal mobile phone. With each shop doing its own social media there is no friction between having an idea and testing it. It is chaotic and vigorous and completely unlike anything corporate.

In their second year as a public company, they do have a corporate side, thanks probably to the analysts and the SEC. From the filings and conference calls we can glean a bit more of their market positioning. They are heavily focused on company owned shops instead of franchising, they use their mobile app to deepen the interaction with their customer (23% uplift in rev per order), and turnover is down, job applications are up (20 per position), and same store sales growth is an impressive 15%.

The chasm between field driven and corporate is something the marketing team must deal with every day. Devising a way to dive down to the shop level, and back up to benchmarks and trends will be essential for moving from hunches to data driven.

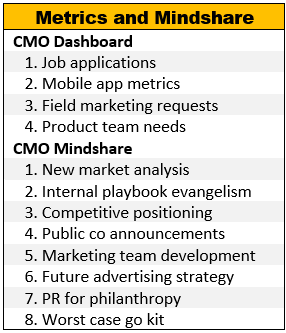

The Dutch Bros CMO Dashboard

Let’s put our heads together and imagine what we would want to see on John Graham’s daily CMO dashboard. With this rate of growth and this rate of turnover, finding and retaining talent has got to be top of mind for everyone leading Dutch Bros. So, every day I would want to look at the job application pipeline. After that, customer engagement happens on the mobile app, so downloads and usage and other app metrics. Then some measures from the field including the way marketing ideas and needs bubble up, and finally something from the product team. Oh right, I forgot to mention there is a secret menu (like In N Out Burger) so somehow the product team has to suck up all of that information and use it to make new products.

After these daily production driven things, I would guess CMO attention is divided between: 1) Analyzing and prioritizing potential new markets, 2) Internal evangelism of the brand playbook, 3) Competitive positioning and pricing, 4) Public co stuff like announcements and disclosures or material items, and 5) Marketing team development, and 6) Future advertising strategy, and 7) A PR plan for the philanthropy stuff, and 8) some kind of a disaster preparedness program to be ready for the negative stuff. It is an exhausting list!

As the one person responsible for the brand promise, and sustaining the pace of growth, riding this bottom up, field driven, upside down roller coaster has got to be invigorating.

What would you be thinking about if you were the CMO? What would you want on the CMO dashboard?

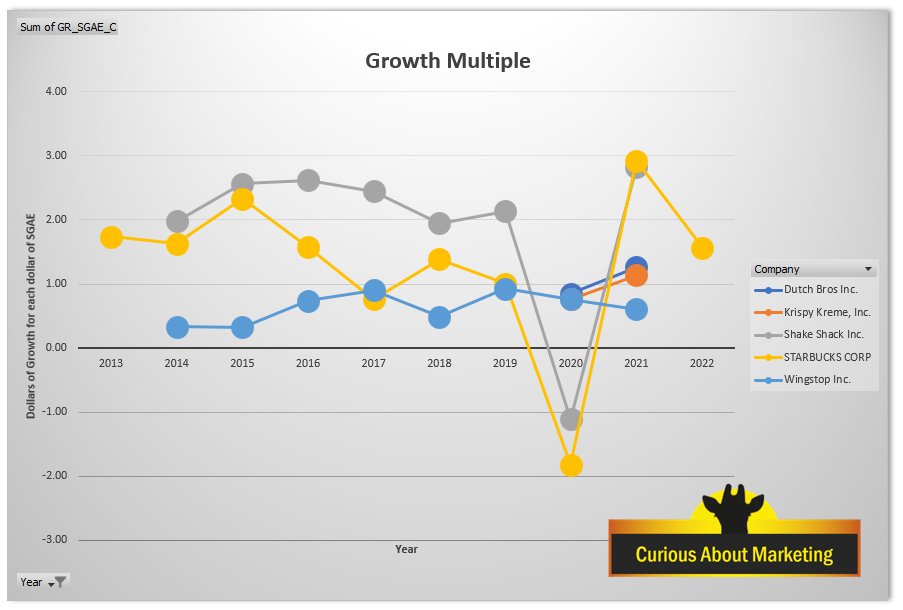

Growth and Cost of Growth Charts

As I outlined in my intro post, I am looking for a systematic way to determine how well company leaders are growing their companies. Here are a couple of charts that show how fast Dutch Bros and some similar companies are growing. Note: Dutch Bros and Krispy Kreme only recently became public companies, so we have much less data for them. Dunkin Donuts (9,000 stores) and Chick-Fil-A (3,000 stores) are both private, so we have no data for them.

It is a bit hard to read because Starbucks and Shake Shack took such a beating in the pandemic. But look at how Dutch Bros, Krispy Kreme, and Wingstop made it through without a contraction. The talk about Dutch Bros growing does show up here in a big way topping out at over 50% last year. (SEC data and Curious About Marketing analysis)

Now let’s look at how much sales, marketing, general and administrative spending it took to drive that growth. This chart shows how many dollars in revenue growth were generated for every dollar in SGA expense.

Again the pandemic warps Starbucks and Shake Shack’s numbers, and makes the chart a bit hard to read. Dutch Brothers performs slightly better than Krispy Kreme, and both are getting more than a dollar of growth back for every dollar spent. Note: I have removed non-cash executive compensation from the SGA expense numbers for all companies – which had the biggest effect on Dutch Brothers.

Disclaimer: I have not interviewed anyone with insider information for this article and do not have any financial interest in the companies referenced in this post.

Continuing the Conversation

Now the fun starts! What do you think about my analysis. Are there entire areas missing? Are my recommendations relevant? What should the priorities be?

Please leave comments below or if you don’t want everyone to see your comments, just reply to this email. I am eager to hear your opinions.

If you want to get periodic updates about Dutch Bros, just reply to this email with “BROS Updates”.

If you have suggestions about other firms I should cover – please send them.

If you have a great giraffe joke – let’s hear it!

Links and References

1) Statista Coffee Industry: https://www.statista.com/topics/1248/coffee-market/#dossierKeyfigures

2) Statista Coffee Revenue: https://www.statista.com/outlook/cmo/hot-drinks/coffee/united-states#revenue

3) IPO at the NYSE: https://youtu.be/s9CwhFQd6g0?t=46

4) Will Southwest Airlines’ meltdown crash the airline’s 51 year reputation: https://www.dallasnews.com/business/airlines/2023/01/08/will-southwest-airlines-meltdown-crash-the-airlines-51-year-reputation/

5) Making a massive difference, one cup at a time! https://www.dutchbros.com/our-impact

6) Leader of DEI Programs, Milly Pineda: https://www.linkedin.com/in/milianapineda/

7) Location to close: https://www.allaboutarizonanews.com/dutch-bros-coffee-shop-location-to-close/

8) QSR Drive Through Report: https://www.qsrmagazine.com/reports/2022-qsr-drive-thru-report

9) Similarweb (subscription): www.similarweb.com

10) Apptopia (subscription): www.apptopia.com

11) SEC Data and Curious About Marketing Analysis: If you want an xlsx workbook with the data calculations in this post, just reply to this email.